WEBINARS AND VIDEOS TO HELP YOU KEEP UP TO DATE ON QRI

UNIT PRICE HISTORY

FUND PERFORMANCE

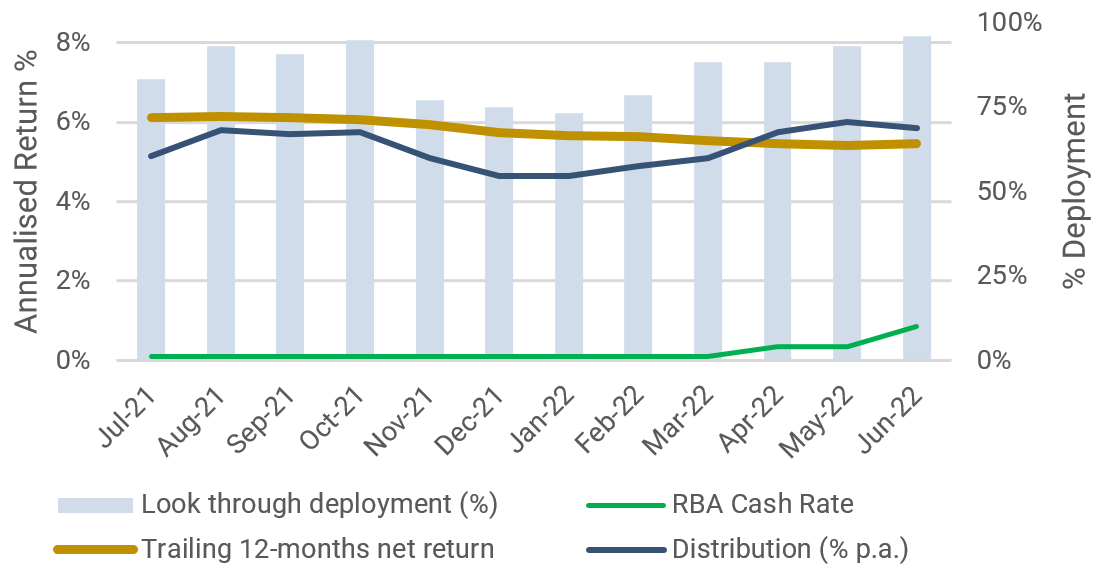

Trailing 12-month returns vs. deployment1,2

Historical net returns by period1,5

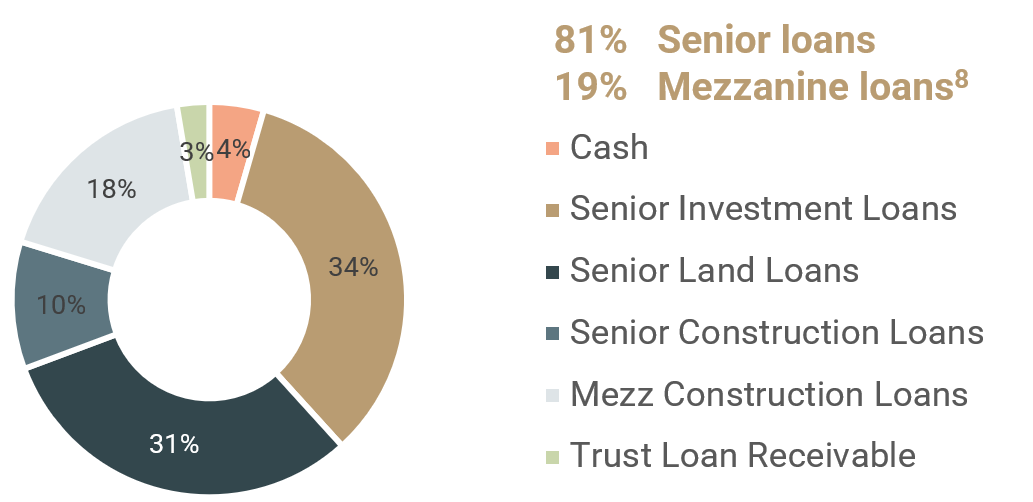

Portfolio Composition6,7

The Trust’s portfolio continues to perform in line with investment objectives with no interest arrears or impairments recorded on any loans7.

1. Past performance is not a reliable indicator of future performance.

2. Deployment is Invested Capital which represents the amount and % of the Trust’s total capital that has been committed and invested as at month end in Investments, including the Trust Loan Receivable. Manager has allowed for an appropriate cash buffer at all times, which will generally be up to 5% of the Trust’s capital.

3. Annualised.

4. IPO in November 2018.

5. Net returns are calculated based on the average month end NAV.

6. The portfolio statistics are determined on a look-through basis having regard to the loans in the underlying Qualitas Funds as indicated. The classifications of these diversification parameters are determined by the Manager. Figures stated are subject to rounding.

7. As at 30 June 2022.

8. Percentage based on total invested capital excludes cash and Trust Loan Receivables.

PERFORMANCE UPDATES & FINANCIALS

ASX ANNOUNCEMENTS

KEY REPORTING DATES

| Full year financial results | Month of August |

| Half year financial results | Month of February |

| Monthly performance update | On or about the 15th of each month |

| Quarterly portfolio update* | On or about the 25th of January, April, July, October *Reporting commenced in March 2020. |

| Distribution advice | On or around 25th of each month |

| Distribution payment date | On or around 16th of each month |

| NAV Reporting | Weekly and each month end |

| NAV month end updates | On or before 14th of each month |

DISTRIBUTION REINVESTMENT

This website is issued by The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235 150 (Perpetual) as responsible entity of the Qualitas Real Estate Income Fund ARSN 627 917 971 (Trust). This website is prepared by QRI Manager Pty Ltd ACN 625 857 070 (Manager) as the investment manager of the Trust. QRI is a wholly owned member of the Qualitas Group and is an authorised representative of the Qualitas Securities Pty Ltd AFSL 342 242.

The information provided in this website is of a general nature only and has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision in respect of the Trust, you should consider the current Product Disclosure Statement (PDS) of the Trust and the Trust’s other periodic and continuous disclosure announcements lodged with the ASX which are available at www.asx.com.au.

Neither Perpetual nor the Manager guarantee repayment of capital or any particular rate of return from the Trust. Neither Perpetual nor the Manager gives any representation or warranty as to the reliability, completeness or accuracy of the information contained in this website. All opinions and estimates included in this website constitute judgments of the Manager as at the date of this website and are subject to change without notice. Past performance is not a reliable indicator of future performance.

The PDS and a target market determination for units in the Fund can be obtained by visiting the Fund website qualitas.com.au/qri. The Trust Company (RE Services) Limited as responsible entity of the Fund is the issuer of units in the Fund. A person should consider the PDS in deciding whether to acquire, or to continue to hold, units in the Fund.