DISCOVER A REAL ESTATE DEBT FUND WITH A DIFFERENCE

Investing in the Qualitas Real Estate Income Fund lets you take advantage of opportunities you may otherwise be unable to access, including:

-

SIMPLE INVESTMENT STRATEGY OF ACTIVELY MANAGED CRE LOANS

The fund invests in an actively managed, diversified portfolio consisting only of CRE loans secured by real property mortgages predominantly in Australia. -

REGULAR MONTHLY INCOME EXCEEDING THE RBA CASH RATE

Loan interest payments provide a source of income, which has consistently delivered monthly distributions since IPO at attractive returns.1 -

ALTERNATIVE LENDING AS A GROWING OPPORTUNITY

Investors gain access to the increasing opportunities of alternative lending as banks withdraw and borrowers seek flexible finance.

- CRE DEBT IS A DEFENSIVE INVESTMENT

Loans secured by real property mortgages provide low risk of capital loss while agreed loan interest rates produce predictable, risk-adjusted returns.2 -

DIVERSIFICATION INTO THE CRE DEBT ASSET CLASS

As a real estate fund that invests in only CRE loans, the fund has low correlation to and is diversified from investments like equities, high-yield fixed income bonds and corporate loans. -

LEADING AUSTRALIAN REAL ESTATE INVESTMENT MANAGER

Qualitas offers unrivalled property finance and institutional grade investment expertise with a track record of disciplined investing, strong returns and no losses since inception.3

1 The payment of monthly cash income is a goal of the Trust only and neither the Manager nor the Responsible Entity provide any representation or warranty (whether express or implied) in relation to the payment of any monthly cash income. Past performance is not a reliable indicator of future performance.

2 Returns are not guaranteed.

3 Since inception of the Qualitas Group in 2008. There is a risk that invested capital may result in loss from investments. Past performance is not a reliable indicator of future performance.

REPORTS, RESEARCH & RATINGS

FREQUENTLY ASKED QUESTIONS

Commercial real estate (CRE) debt refers to loans made to commercial borrowers who require funding for real estate purposes. All CRE loans are secured by real property mortgages.

The borrowers are typically property developers, private corporations or high net worth individuals. CRE loans are distinct from home loans made to individuals.

CRE loans can be used to purchase land that is vacant, developable or improved (with buildings, utilities or other services), or property (buildings that are complete or under construction). The land or property is the mortgage collateral (or security) for the loan, and investors earn income from the ongoing loan interest and fees.

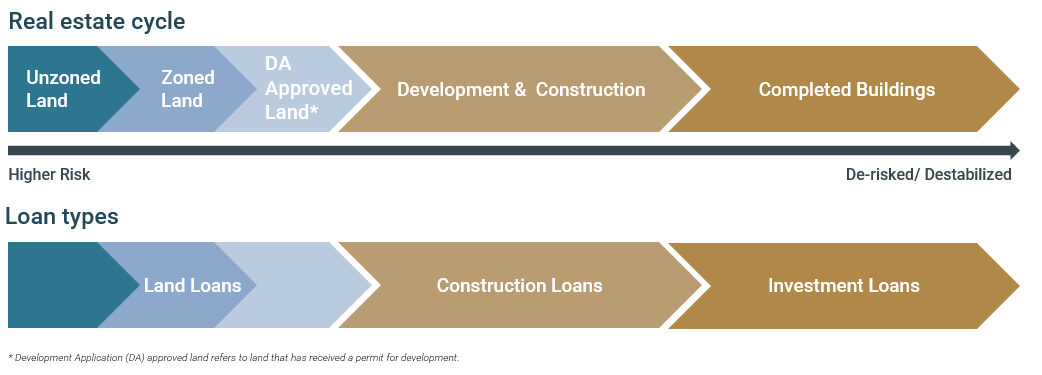

Types of loans include:

- Land (pre-development) loans: Used to fund land that has been approved for development

- Construction loans: Used to fund property development and construction costs

- Investment loans: Used to fund real estate assets (buildings that can be occupied) that generate income

Loans across the real estate life cycle

CRE loans may provide an alternative way to earn income, especially for those investors looking for predicable income though attractive risk-adjusted returns1. The ongoing interest payments from CRE loans – which have agreed interest rates and fees – underpin this regular income, which is typically paid to QRI investors in the form of distributions.

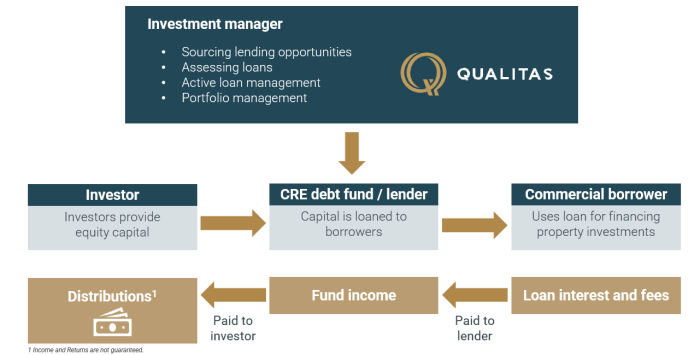

Qualitas is a leading Australian-based manager of CRE debt. As a property specialist, Qualitas – on behalf of investors – sources lending opportunities in the CRE debt market, undertakes credit assessment of the loan and actively manages the loan performance and risks for the loan term.

How CRE debt generates regular income

Qualitas is an alternative lender that provides CRE loans to commercial borrowers such as property developers. An alternative lender is not a traditional bank, with the main difference being how they raise capital to fund their lending activities. While a bank will raise capital from deposits and wholesale funding, an alternative lender will raise equity capital from investors.

According to APRA, 90% of the Australian CRE debt market (worth $403 billion) is provided by banks1. The remaining gap of 10% (worth around $45 billion) is provided by alternative lenders2. Senior loans represent the majority of opportunities in the market.

The opportunity for alternative lenders is underpinned by the following:

- Every year the CRE debt market has grown between 2-5%, due to supportive macroeconomics in recent times.

- Bank withdrawal from CRE lending due to APRA and government regulation has widened the gap for alternative lenders.

- Borrowers are willing to pay a premium for more flexible and bespoke forms of finance e.g. mezzanine lending is typically only provided by alternative lenders.

Qualitas, as an experienced manager of CRE debt, is well positioned in the Australian market due to our long-standing local presence and deep borrower relationships built on trust and repeat lending.

Qualitas is a “through-the-cycle” investor. We are sector agnostic and always seek to invest in the best risk-adjusted return opportunities having regard to the timing within the cycle of the market.

1. APRA Quarterly Authorised Deposit-taking Property Exposures March 2022; 2. RBA Financial Stability Review October 2021.

*Manager estimates

Australian CRE debt market opportunity*

CRE debt is attractive to investors seeking predictable income and capital stability, and provides exposure to the property market without the need to actually own property. Its benefits include:

Predictable and regular income5

- The loan interest and fees are agreed upfront, to provide fixed income for the loan term.

- Can provide cash flow from regular interest payments.

Capital preservation and portfolio diversification

- The loan value does not fluctuate like property values.

- CRE debt ranks ahead of equity, meaning it is repaid first.

- CRE debt has the benefit of security i.e. mortgages over property, which can be sold to meet loan repayment.

- The equity buffer provides downside protection – depending on the loan-to-value (LVR) ratio, property values will need to fall to a certain level before the loan is at risk of not being fully repaid.

While CRE debt is a relatively new asset class for retail investors in Australia, it has been available to wholesale investors for decades. As banks have reduced their exposure to CRE loans, alternative lenders such as Qualitas have increased their market share and brought this asset class to retail investors.

5 The payment of regular monthly cash income is a goal of the Trust only and neither the Manager nor the Responsible Entity provide any representation or warranty (whether express or implied) in relation to the payment of any monthly cash income. Past performance is not a reliable indicator of future performance.

- Banks have a fairly inflexible set of lending parameters for assessing CRE loans, which excludes a number of quality borrowers.

- These borrowers look to alternative lenders because they need flexibility and are willing to pay a premium for it in order to do business. Examples include:

- Lending for properties or land that may be outside the bank’s risk appetite due to caps on CRE lending generally or restrictions on certain areas or property sectors.

- Providing additional leverage or more relaxed terms than banks are willing to provide.

- Mezzanine lending (i.e. second mortgages), which is typically only provided by alternative lenders.

- Speed and certainty of funding.

Qualitas will always assess a CRE loan to determine an acceptable interest rate (i.e. pricing) that reflects the acceptable risk, having regard to market pricing at the time.

CRE loans provide exposure to the property market without the downside risk of owning the property, including decline in value or loss of rental income from vacancies.

Due to the capital structure, CRE debt capital is more stable than equity as a source of funding.

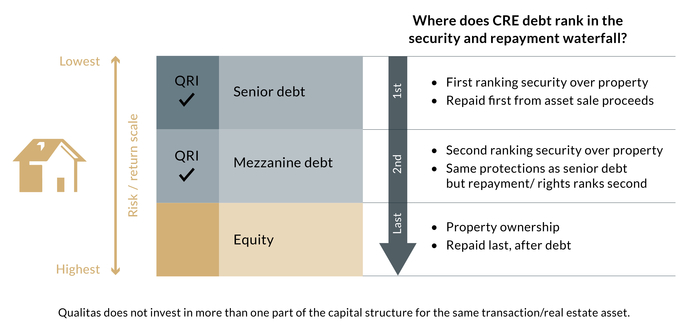

CRE debt has the security of a real property mortgage, which provides the lender with the right to sell the property to recoup payment of the loan if the borrower defaults. CRE debt ranks ahead of equity and will always be paid first from sale proceeds.

Payment priority within CRE debt means senior debt (first mortgage) is paid first, and mezzanine debt (second mortgage) is paid second.

Providers of CRE debt (i.e. the lender) may also be protected by the equity buffer, which is the difference between the property value and the loan value. The equity buffer will fluctuate with property values, and would need to be eroded completely before the lender is at risk of losing the loan value.

The CRE debt market covers a broad range of loan types including land, investment and construction loans, as well as all property sector asset classes such as residential (multi-dwelling), office, hotel and industrial.

Owning these types of assets directly comes with risks, particularly around valuations, as the capital value of assets can rise and fall in line with market cycles. Income is also variable, based on rental demand and market rates.

On the other hand, the value of a loan is relatively stable and the income is relatively predictable compared to property ownership. The loan amount and interest rate are agreed at the outset, and so the value and income are known in advance.

While the income generated from the CRE loans in the QRI portfolio is relatively stable, the dynamic nature of the portfolio’s composition means the income may change slightly from month to month.

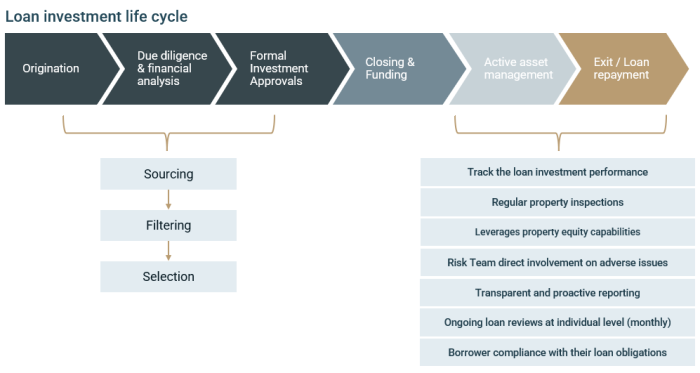

Protecting investors’ capital is our highest priority and our investment processes have institutional-grade governance and structure similar to that of banks. This seeks to provide protection against the risk of capital loss throughout the loan investment life cycle – from origination, investment due diligence and approvals to risk management, active asset management and loan repayment.

Our rigorous due diligence and credit assessment focuses on two areas:

- The credit worthiness of the borrower – this includes the borrower’s business operations, track record, management team, company owners, financials and property portfolios.

- The quality of the property – we verify the real property asset including whether it could be resold or leased out, the location and its supporting features and demographics.

Qualitas’ investment processes are different to a bank in the following ways:

- We have greater flexibility to make decisions based on the merits of each loan with regard to QRI’s current risk/return appetite. A bank will often have rigid lending practices which make them more inflexible.

- We undertake a much more proactive approach to asset management to ensure loan performance is managed as appropriate for the risk profile.

- Our equity investment capabilities and in-house property development team allow us to assist the borrower if required to manage difficult loan performance or project issues.

- We undertake individual loan asset reviews every 6-8 weeks, which is a lot more frequent than banks (who only review loan assets once or twice a year).

The Qualitas investment process for CRE debt lending

KEY RISKS

This website does not constitute an offer to invest in the Trust. All investments are subject to risk, which means the value of investments may rise or fall, and you may receive back less than your original investment or you may not receive income over a given time frame. The key risks associated with investing in the Trust include: distributions may not be paid, the Manager may not find appropriate investments, hedging risk, service provider risk, potential conflicts of interests, ASX liquidity risk, investment risk, credit and default risk, credit margin risk, investment strategy risk, related party risk, and legal and regulatory risk. Please refer to section 8 of the PDS for a comprehensive summary of potential risks.

This website is issued by The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235 150 (Perpetual) as responsible entity of the Qualitas Real Estate Income Fund ARSN 627 917 971 (Trust). This website is prepared by QRI Manager Pty Ltd ACN 625 857 070 (Manager) as the investment manager of the Trust. QRI is a wholly owned member of the Qualitas Group and is an authorised representative of the Qualitas Securities Pty Ltd AFSL 342 242.

The information provided in this website is of a general nature only and has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision in respect of the Trust, you should consider the current Product Disclosure Statement (PDS) of the Trust and the Trust’s other periodic and continuous disclosure announcements lodged with the ASX which are available at www.asx.com.au.

Neither Perpetual nor the Manager guarantee repayment of capital or any particular rate of return from the Trust. Neither Perpetual nor the Manager gives any representation or warranty as to the reliability, completeness or accuracy of the information contained in this website. All opinions and estimates included in this website constitute judgments of the Manager as at the date of this website and are subject to change without notice. Past performance is not a reliable indicator of future performance.

The PDS and a target market determination for units in the Fund can be obtained by visiting the Fund website qualitas.com.au/qri. The Trust Company (RE Services) Limited as responsible entity of the Fund is the issuer of units in the Fund. A person should consider the PDS in deciding whether to acquire, or to continue to hold, units in the Fund.

BondAdviser has acted on information provided to it and the content of the research report is not intended to provide financial product advice and must not be relied upon as such. The statements and/or recommendations in the research report are the opinions of BondAdviser only. Neither the accuracy of the data nor the methodology used to produce the report can be guaranteed or warranted. BondAdviser has taken all reasonable steps to ensure that any opinion or recommendation in the content or the research reports is based on reasonable grounds, noting that some of the information in the content or the reports is based on information from third parties. Details regarding BondAdviser methodology and regulatory compliance are available at http://bondadviser.com.au/documents-and-links. BondAdviser recommends investors read the full research report and disclaimers therein.

The Independent investment research (IIR) research report should be read in its entirety including the disclaimer and disclosure noted in the report. IIR recommends that you do not make any investment decision prior to consulting your wealth adviser about the contents of the IIR research report.

The Zenith Investment Partners (ABN 27 103 132 672, AFS Licence 226872) (“Zenith”) rating (assigned 10 June 2021) referred to in this document is limited to “General Advice” (s766B Corporations Act 2001) for Wholesale clients only. This advice has been prepared without taking into account the objectives, financial situation or needs of any individual and is subject to change at any time without prior notice. It is not a specific recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision and should consider the appropriateness of this advice in light of their own objectives, financial situation and needs. Investors should obtain a copy of, and consider the PDS or offer document before making any decision and refer to the full Zenith Product Assessment available on the Zenith website. Past performance is not an indication of future performance. Zenith usually charges the product issuer, fund manager or related party to conduct Product Assessments. Full details regarding Zenith’s methodology, ratings definitions and regulatory compliance are available on our Product Assessments and at http://www.zenithpartners. com.au/RegulatoryGuidelines.

The rating issued 10/2021 is published by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec). Ratings are general advice only, and have been prepared without taking account of your objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and Lonsec assumes no obligation to update. Lonsec uses objective criteria and receives a fee from the Fund Manager. Visit lonsec.com.au for ratings information and to access the full report. © 2021 Lonsec. All rights reserved.